APRA recently acknowledged that serviceability requirements had become too strict. So now they have widened the goal posts to help banks to lend you a lot more than they could have just a few short months ago.

Let’s look at some numbers.

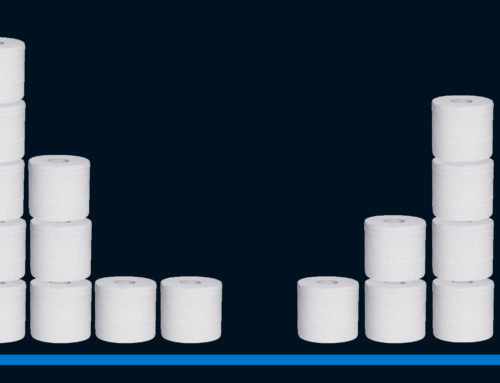

Previously, for a couple with no debts and a combined income of $120k, you could borrow about $550k. That number is now about $670k. A similar improvement might easily apply in your situation.

We recently spoke about your hidden assets, and discovered your borrowing ability was one of them, yet many capable borrowers have recently not been able to borrow enough to meet their goals. But now:

markets are improving in five of our capital cities;

interests rates are lower than they’ve ever been;

Rental returns are increasing relative to mortgage payments;

And there’s post election happiness around negative gearing and capital gains tax.

All of the above combined could mean:

moving to a better home or suburb;

being able to afford your first home;

or acquiring an investment property by using your existing equity and your new borrowing ability.

And because of the way principal and interest work together, with rates now so low you’ll owe a lot less much sooner.

APRA have given the green light to borrowers to get back into the property market. So why not research the market while I help you research your financing options?

I’ll help you find out what your new borrowing ability is, and show you how to best protect it while using it to your greatest advantage. So if you would like your next home sooner, or even just review your current loans, let me know if you would like a free check up to see what’s now possible for you.

This article and the contents provides general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and talk with your financial or other professional adviser before making an investment or financial decision. The contents of this article are not to be relied upon as a substitute for financial or other professional advice. Figures quoted are indicative only